Finance Utilities

Finance Utilities - Release notes

Finance Utilities - Release notes

This document describes the features that are either new or changed in the release version mentioned.

DXC Finance Utilities 10.0.36 runs on the following Microsoft releases

| Base | Version | Release |

|---|---|---|

| Microsoft Dynamics 365 application | 10.0.36 | What’s new or changed in Dynamics 365 application version 10.0.36 |

| Microsoft Dynamics 365 application | 10.0.37 | What’s new or changed in Dynamics 365 application version 10.0.37 |

| Microsoft Dynamics 365 application | 10.0.38 | What’s new or changed in Dynamics 365 application version 10.0.38 |

Note: From 10.0.32 MS has added a feature (on by default) called Time zone for importing bank statements using Electronic reporting.

Finance utilities doesn’t currently support converting date/time fields within the bank statement file.

Release date: 2 February 2024

New features

| Number | Module | Functionality | Description |

|---|---|---|---|

| 16332 | System administration | Business event for electronic reporting export | New Business event Electronic reporting file exported to azure blob. Option to create an event when exporting ER file to Azure Blob via ‘Electronic reporting export connections’. |

| 16596 | Organization adminstration | Electronic reporting export connection | ‘Validate connection’ functionality added |

Bug fixes

| Number | Module | Functionality | Description |

|---|---|---|---|

| 16873 | Accounts payable | Payment advice print | Finance utilities was referencing ‘ECL_BankPaymAdviceVendV2’ report when printing Vendor Payment advice. When the report wasn’t deployed to an environment, printing would error with ‘Parameter _reportName cannot be null or empty’. Reference to the ECL report has been removed. |

| 16897 | Accounts payable Accounts receivable |

ABN validation | Only applicable to 10.0.36.2023111661. When ABN validation was active for the legal entity, any changes on the vendor/customer resulted in ABN validation dialog popping up. |

| 16959 | Various | - Financial utilities connections - Electronic reporting export connections |

Increase EDT for usernames, passwords (sftp, ftp) and storage account name, storage account key (Azure blob) |

| 16976 | Accounts reveivable | Interest note - Due date | Waive, reinstate and reverse of interest notes also now utilize ‘Use customer payment terms’ option. |

Release date: 12 January 2024

Bug fixes

| Number | Module | Functionality | Description |

|---|---|---|---|

| 16822 16754 |

Data management | ABN validation - Import entities TaxVATNumTable & VendVendorV2 | ABN validation GUI popup wrapped around a condition for data import scenarios. Also removed the previous ‘Skip validation’ method when importing Vendors entity. When ABN validation is enabled for the legal entity and the entities imported, ABN validation will occur without the GUI popup. Records with valid ABNs will be imported and only invalid ABN staging records will error. |

Release date: 21 December 2023

Bug fixes

| Number | Module | Functionality | Description |

|---|---|---|---|

| 16794 | Accounts payable | Vendor approval | Related only to earlier versions of 10.0.36.20231116 - deprecating Vendor bank account approval. Resulted in values not being retained for client extended fields in Vendor approval. |

Release date: 14 December 2023

Bug fixes

| Number | Module | Functionality | Description |

|---|---|---|---|

| 16758 | Accounts payable | Vendor approval | Proposed changes disregarded for changes to standard vendor fields. |

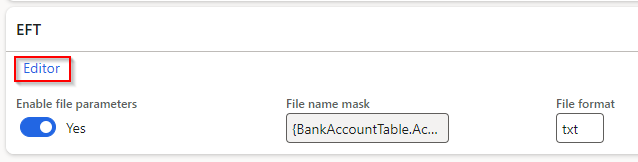

| 16765 | Accounts payable | Method of payment EFT file name Editor |

Label fix and saving of changes to file name mask. |

Release date: 8 December 2023

Bug fixes

| Number | Module | Functionality | Description |

|---|---|---|---|

| 16747 | N/A | Deployment | Bug fix only applicable to 10.0.36.2023111621, which included unit tests. To remove unit tests, use the following instructions to remove the package/uninstall unit tests. |

Release date: 30 November 2023

New features

| Number | Module | Functionality | Description |

|---|---|---|---|

| 15693 | Cash and bank management | Reverse mark as new transaction | Support added for reversing mark as new transactions offsetting to vendor, bank or customer within the same legal entity. Supports features: • Enable bank reconciliation reversal even new transactions exist in posted bank statement • Reverse posted bank statement with new transactions |

Bug fixes

| Number | Module | Functionality | Description |

|---|---|---|---|

| 16584 | Accounts payable | Vendor bank account approval | Proposed changes disregarded for changes to standard vendor bank account fields. |

Release date: 16 November 2023

Deprecated

| Number | Module | Functionality | Description |

|---|---|---|---|

| 15394 | Accounts payable | Vendor bank account change workflow | Deprecate Vendor bank account fields in Vendor approval. See Deprecated features notice - Vendor bank account change workflow for more details. |

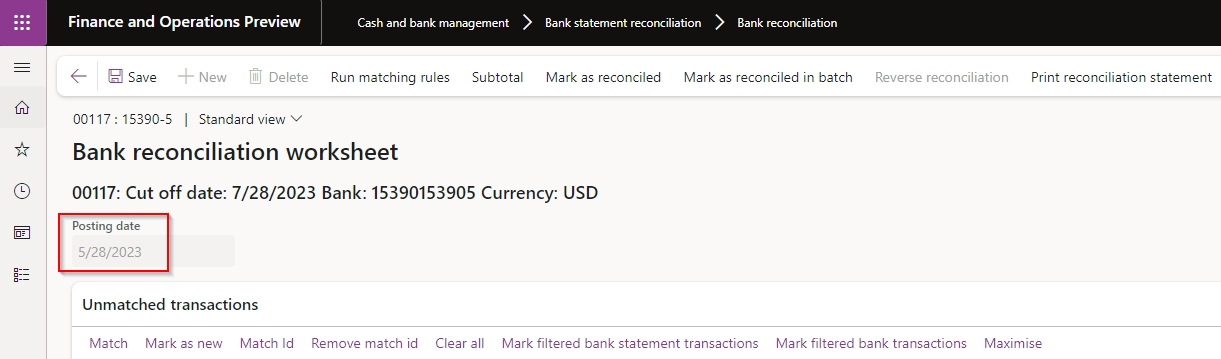

| 16002 | Cash and bank management | Mark as new transaction’s Posting date | Deprecate Posting date functionality for Mark as new transactions. See Deprecated features notice - Posting date for more details. |

New features

| Number | Module | Functionality | Description |

|---|---|---|---|

| 15488 | Accounts receivable | Interest notes - Due date | New field called Use customer payment terms added to Accounts receivable parameters and Credit and collections parameters (Collections tab). If set to Yes, the customer’s payment terms will be used to determine Due date when posting Interest notes. Guide |

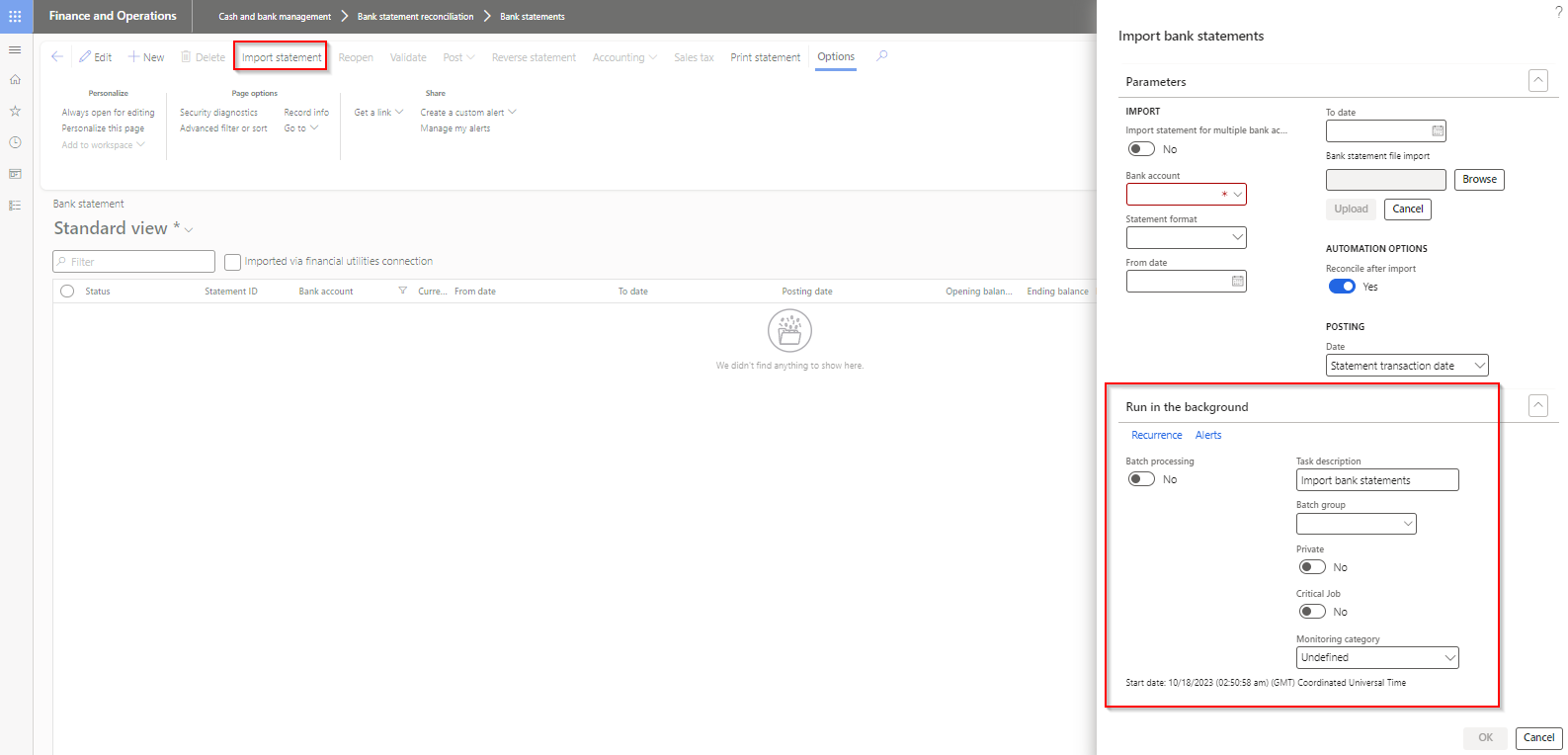

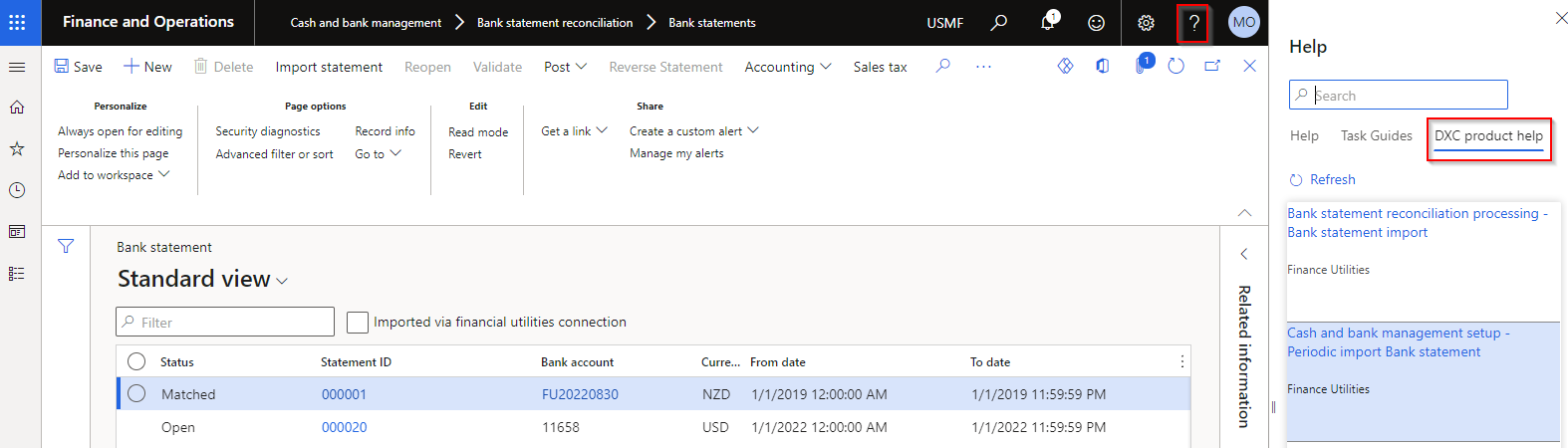

| 16039 | Cash and bank management | Bank statement import | Run in the background functionality added to Import bank statements  |

| 16471 | Encryption | DXC encryption parameters: Rename field KeyVaultSignerPublicKey (Signer’s public key) to KeyVaultReceiverPublicKey (Receiver’s public key) | |

| 16401 | Accounts payable | Vendor bank account - Lodgement reference | Increased Lodgement reference EDT from 18 to 20 |

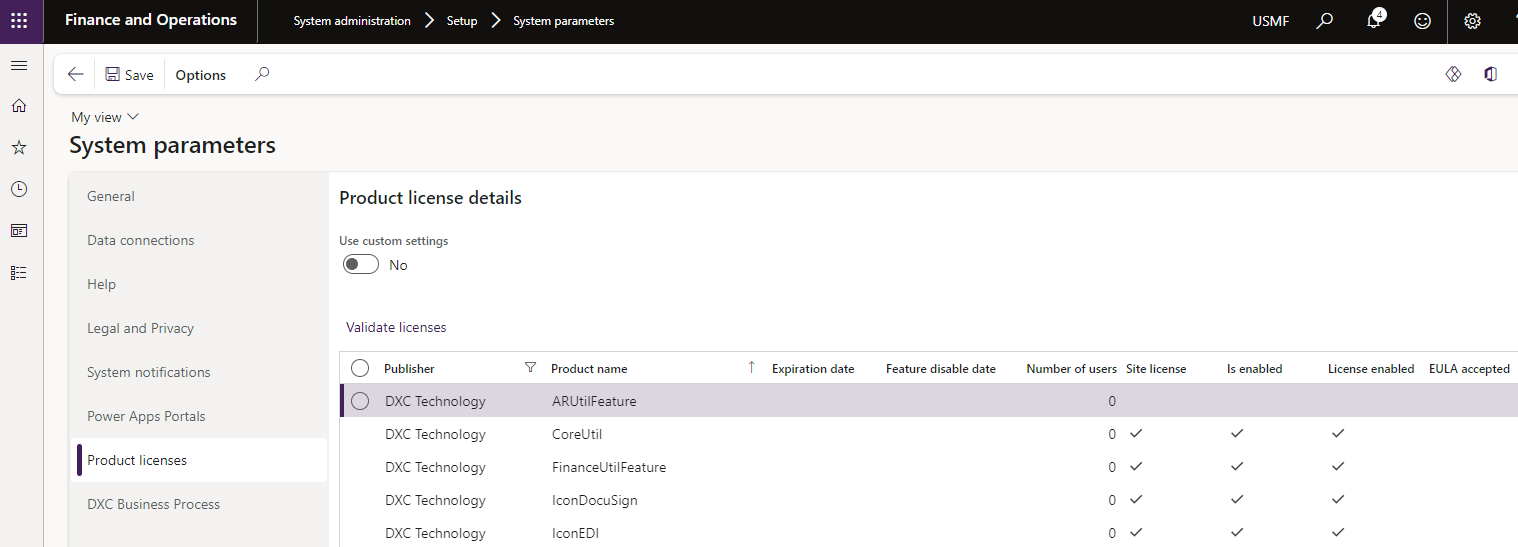

| N/A | DXC License | DXC License 10.0.34.202310311 - Includes feature managed SmartSend and Core extensions |

Bug fixes

| Number | Module | Functionality | Description |

|---|---|---|---|

| 16069 | Unit tests | Fix 10.0.37 build issues for Finance utilities Unit tests | |

| 16244 | Cash and bank management | Import statement | Code change in 10.0.37 that makes ‘Bank account’ mandatory when using ‘Import statement for multiple bank accounts in all legal entities’ |

| 16036 | Data management | Import data entity Document types | Couldn’t import the entity with Finance utilities field DFUGEREXPORTCONNECTION. Error: ‘The column ErrorCode in entity Document types has incorrect data. Please correct the data and try the import again.’ |

This section describes the features that have been removed, or planned to be removed from a Finance utilities version.

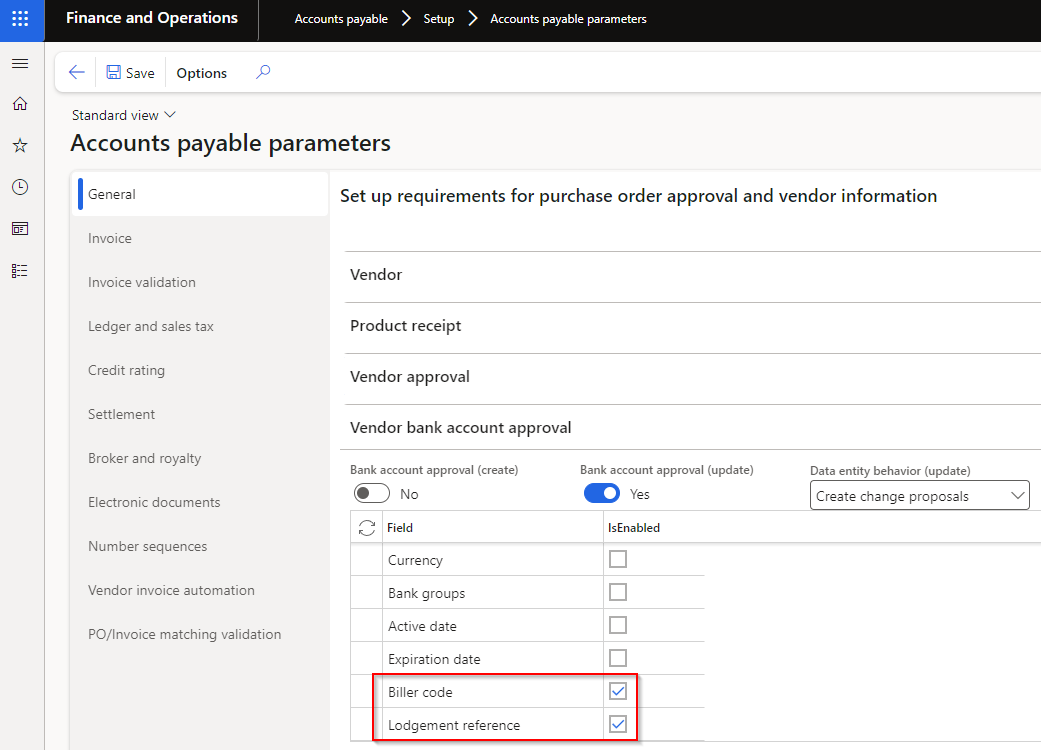

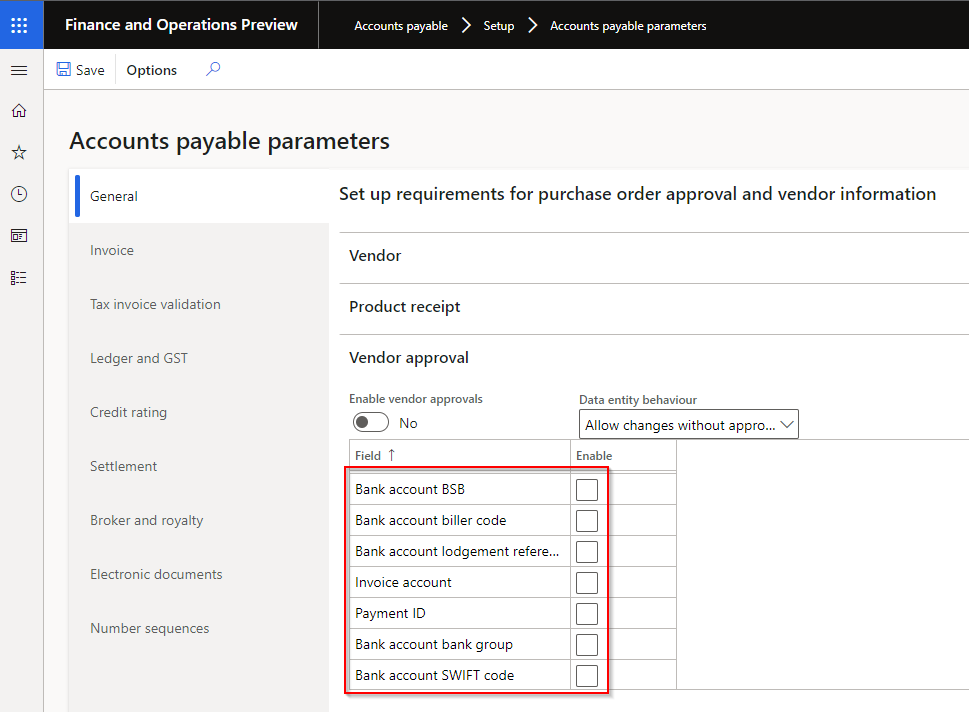

Note: The Finance utilities fields (Biller code and Lodgement reference) have been added to standard ‘Vendor bank account approval’ FastTab in Accounts payable parameters in Finance Utilities version 10.0.35.202307311.

Approximately one year of previous versions are included below.

Release date: 14 November 2023

Bug fixes

| Number | Module | Functionality | Description |

|---|---|---|---|

| 16460 | Cash and bank management | Intercompany bank Mark as new transactions | 16338’s change to intercompany bank mark as new, created a bank statement in the destination company to create intercompany reconciled bank transactions. This has now been changed to not create a bank statement in the destination legal entity. It now creates an unreconciled bank transaction in the destination company using the following from originating company: Debit/Credit Amount, OffsetLedgerDimension, BankTransType, OffsetTxt, OffsetCompany, OffsetAccountType, ExchRateSecond, ExchRate, CurrencyCode, Voucher, TransDate, LedgerDimension, AccountType, JournalNum |

Release date: 2 November 2023

New features

| Number | Module | Functionality | Description |

|---|---|---|---|

| 16429 | Cash and bank management | Bank statement / reconciliation | Update ledgers used for mark as new Intercompany bank transactions. Previously used LedgerInterCompany fields CustLedgerDimension and DebitLedgerDimension, but these aren’t available in the Intercompany accounting form. Now using: OriginatingDebitLedgerDimension or OriginatingCreditLedgerDimension and DestinationCreditLedgerDimension or DestinationDebitLedgerDimension. |

Bug fixes

| Number | Module | Functionality | Description |

|---|---|---|---|

| 16338 | Cash and bank management | Intercompany bank Mark as new transactions | Additions to 15578. Applicable to when a bank statement line is marked as new and offset to an intercompany bank account. Previously only supported when bank statement is posted via ‘Mark as reconciled’ (Auto-post bank statement is set to Yes), and feature ‘Advanced bank reconciliation improvement: enable filtering and provide separate grid for new transactions’ disabled. Now supports the feature enabled and posting the bank statement from the Bank statement page (Auto-post bank statement is set to No) as well. |

| 16250 | Cash and bank management | Import statement | Incorrect warning message when importing bank statement and the file contains multiple bank accounts and the import parameters is filtered to one bank account that exists in the file: ‘Failed to match with bank account’. It also warned about No matching bank account found for bank accounts that doesn’t exist in D365, but the import was only filtered to one specific bank account. |

Release date: 4 October 2023

Bug fixes

| Number | Module | Functionality | Description |

|---|---|---|---|

| 16114 | ABN Validation | Customer and Vendor ABN validation | Decouple DXCABNValidation from DXCFinanceUtilities enabling companies to remove model DXCABNValidation. |

Release date: 31 August 2023

New features

| Number | Module | Functionality | Description |

|---|---|---|---|

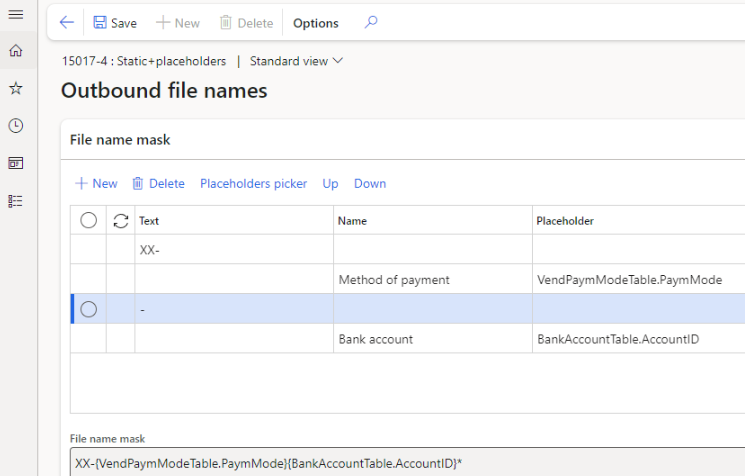

| 15017 | Accounts payable | EFT file name generation | Ability to set static values and select placeholders for EFT file name in Vendor’s Method of payment User guide   |

| 15578 | Cash and bank management | Bank reconciliation | When bank statement line is marked as new and offset to an intercompany bank account, the postings will now be created as intercompany. Example: • Current company: Debit I/C Receivable and Credit Bank account • Intercompany: Debit Bank account and Credit I/C Payable |

Bug fixes

| Number | Module | Functionality | Description |

|---|---|---|---|

| 15891 | Cash and bank management | Bank reconciliation | Only issue in 10.0.35.202307311. When running matching rules, the lines are not moved to matched/new transactions |

| 15976 | Cash and bank management | Bank reconciliation | When running Reconciliation matching rule offsetting to account type Customer, the customer payment journal line’s Approved will now be set to Yes. Else the record is not available to be settled. |

| 15899 | Accounts payable | Payments report | Only issue in 10.0.35. When printing the Payments report in Vendor payments, every 2nd page is blank. |

Release date: 31 July 2023

New features

| Number | Module | Functionality | Description |

|---|---|---|---|

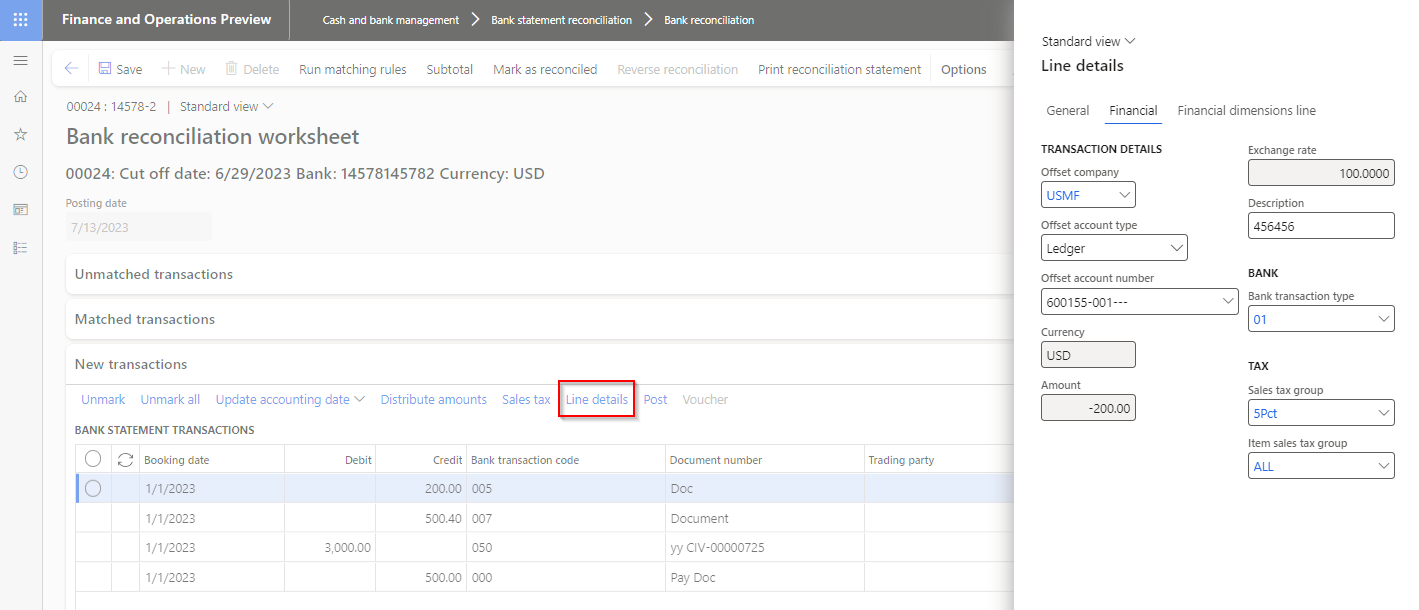

| 14578 | Cash and bank management | Bank reconciliation | Support for manually setting offset details when enabling feature Advanced bank reconciliation improvement: enable filtering and provide separate grid for new transactions. This feature adds section New transactions in the Bank reconciliation and in 10.0.35 MS added additional button Line details. Finance utilities now utilises Line details for the ability to manually set offset details for mark as new transactions.  Note: Using button Cancel on Line details currently still saves any changes. Bug has been reported to Microsoft and fix will be included in 10.0.37 |

| 14929 | Cash and bank management | Bank statement import | Decimal adjustment was limited to 5 decimals. Have been changed to dynamic and now supports higher than 5 decimals. |

| 14088 | Cash and bank management | Bank statement import - Periodic task | Currently when the periodic task Import bank statements via financial utilities connection’s Bank statement format’s Custom format is: • Yes: By design if there are issues with creating bank statement for any of the accounts in the file (example bank account doesn’t exist in D365) , no bank statements are created and the file is moved to error path (instead of archive). • No: Std creates bank statements for all valid bank accounts using the Electronic reporting configuration - we have no control over this. This change: will move the file to Error path / container (instead of archive path) if not all bank statements could be created when using the periodic task and the bank statement format’s Custom format is set to No. |

| 15410 | Accounts payable | Vendor bank account approval | Support for 10.0.32 feature ‘Vendor bank account change proposal workflow’ / ‘Supplier bank account change proposal workflow’ which is on by default from 10.0.35. Added the following Finance utilities fields to Vendor bank account approval: • Biller code • Lodgement reference Note: Finance utilities includes vendor bank accounts fields in Vendor approval, which has now been replaced by this MS feature, and will be deprecated in the next Finance utilities release. Please migrate your vendor bank account approval setup from Vendor approval to Vendor bank account approval before the next release. Deprecation notice  |

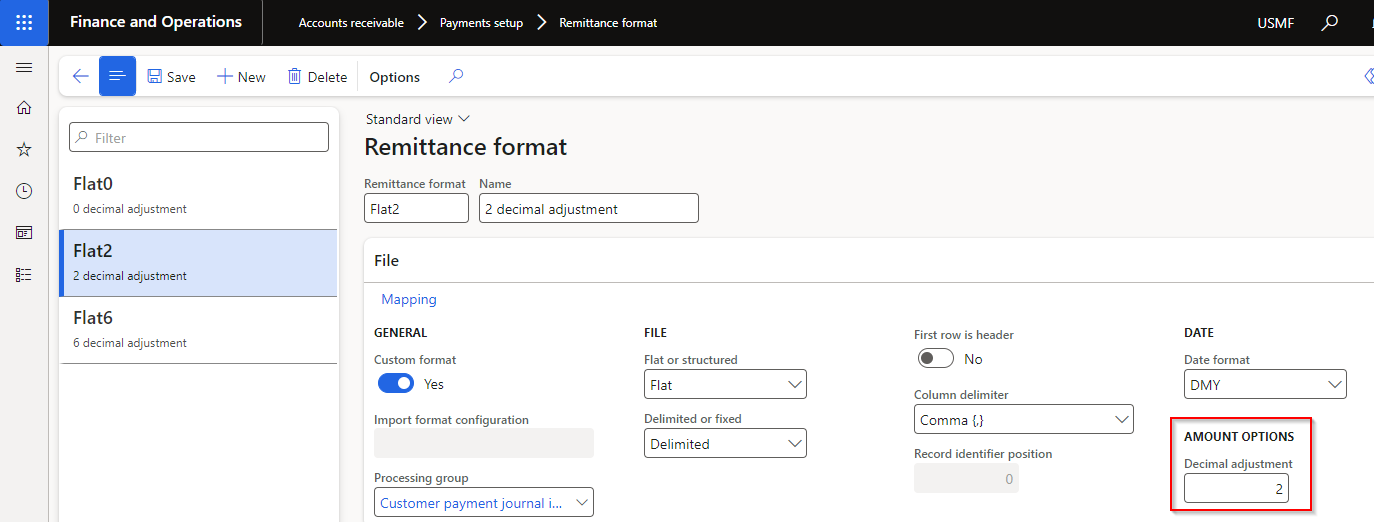

| 14099 | Accounts receivable | AR Utilities | Added Amount Decimal adjustment option to Remittance format  |

| N/A | Licensing | DXC License & DXC License manager | New versions included: • DXC License 10.0.34.202307311 • DXC License Manager 10.0.32.202307312 |

Bug fixes

| Number | Module | Functionality | Description |

|---|---|---|---|

| 14619 | Cash and bank management | Bank statement import - Custom formats | Ability to map non transaction record custom line codes. Previously if Opening or Closing balance custom line codes where set in Custom line codes, these were imported as transaction records. |

| 15482 | Cash and bank management | Bank statement import - Custom formats | When using mapped Ending balance field, the opening balance was added to the imported bank statement’s ending balance |

| 15199 | Cash and bank management | Reconciliation matching rules set | Extension to processMatchRuleSet to support reprocessing unmatched bank statement lines. The issue came in where the filter criteria for each rule in the set found the same bank statement lines, but the rules used different bank statement fields to find the D365 customer account to post the customer payment journal. Example - Reconciliation matching rule set where all the rules filters to same criteria that matches to 15 bank statement lines: Rule 1: Uses Bank statement field Description to find the D365 customer account, but only 3 lines could find a D365 customer account in this field to successfully post. Rule 2: Uses Bank statement field Entry reference to find the D365 customer account. The expectation would be that Rule 2 would find the remaining 12 bank statement lines and post the applicable ones, but it found 0. Before this change, only rule 1 in the set found bank statement lines, and subsequent rules found 0. |

| 15390 | Cash and bank management | Bank reconciliation | When running a Mark new transactions Reconciliation matching rule that: • Posts customer payment journals and • Financial utilities parameters Only match posted statement lines was set to Yes and • No journals were successfully posted (for example couldn’t find any matching D365 customer account for all the lines) All unmatched bank statement transactions, that matched the criteria, where moved to matched. |

Release date: 15 June 2023

New features

| Number | Module | Functionality | Description |

|---|---|---|---|

| 14332 | Cash and bank management Accounts receivable |

Financials utilities connection | Update to support Azure Blob Storage related method depreciation in 10.0.34. Replaced StartCopyFromBlob with BeginStartCopy Obsolete API |

| 12430 | Cash and bank management | Reconciliation matching rules | New field Offset account reference bank statement field provides the ability to use Customer reference to find the applicable D365 customer account when running a Mark new transactions Reconciliation matching rule offsetting to customer. |

| 14536 | Cash and bank management | Bank statements | Ability to map Ending balance on custom bank statement formats. Where this is mapped, the imported bank statement’s ending balance will be used to populate the Bank statement’s ending balance field. This is useful to validate that bank statements are imported in the correct sequence. |

| 14332 | Accounts payable | Model reference | Added FinTag model reference to Finance utilities |

| 14524 | Accounts payable | Payments report | Added new field for Vendor’s bank name |

Bug fixes

| Number | Module | Functionality | Description |

|---|---|---|---|

| 14532 | Cash and bank management | Bank reconciliation report | Fixed Report’s Txt field’s ExtendedDataType to match Bank account transaction’s Txt field. |

| 14696 | Cash and bank management | Bank statement import - Custom formats | Issue with 88 continuation line’s string size. |

Release date: 18 May 2023

New features

| Number | Module | Functionality | Description |

|---|---|---|---|

| 12631 | Cash and bank management | UI updates | • Update header on Bank accounts ‘EFT parameters’ to ‘AP EFT parameters’ • Bank reconciliation warning log updated where the customer payment journal isn’t automatically posted: “Customer payment journal % has been created successfully. Please post the payment journal manually, refresh the worksheet and manually match with the new bank transactions.” |

Bug fixes

| Number | Module | Functionality | Description |

|---|---|---|---|

| 14277 | Cash and bank management | Bank statement | Importing bank statement file that contains multiple bank accounts in different legal entity’s errored with: “The bank account % must enable the parameter Advanced bank reconciliation” for bank accounts in different legal entity. |

| 13554 | Cash and bank management | Bank reconciliation | From 10.0.31 when feature ‘New voucher and date for new transactions in the advanced bank reconciliation bank statement’ was enabled and running a mark as new reconciliation rule that offsets to Vendor, it didn’t create the record in the vendor subledger. |

| 14096 | Cash and bank management | Reconciliation report | Timeout on report when bank account has a large number of transactions. |

| 14230 | Accounts receivable | AR Utilities | Update Error customer account logic to work with blank invoice. |

| 14239 | Accounts receivable | Data management | Importing entity ‘Customers V3’ errored when ABN lookup is enabled. |

| 12902 | Accounts payable | Data management | Importing entity ‘Vendors V2’ errored when ABN lookup is enabled. |

| 14333 | Accounts payable | Generate payments | Only issue where the GER file is automatically saved to Azure blob storage with keyvault. Added security privilege to duty ‘Maintain vendor payments’. Error: “Access denied to field Key Vault secret key (SecretKey) in table Key Vault parameters (KeyVaultParameters).” |

Release date: 5 May 2023

New features

| Number | Functionality | Description |

|---|---|---|

| 12644 | Customer references | Ability to set multiple references against customers - Setup. These references can be used in the following scenarios: • Customer remittance file refers to a reference unique to the customer, but not an invoice number. This reference can be used to find the applicable customer account when creating the customer payment journal while importing customer remittances using the additional licensed feature AR Utilities. • Roadmap: Reconciliation matching rules additional ability to use the customer reference to find the applicable customer account when creating the customer payment journal. |

| 11357 | Import customer remittance file | New licensed feature included in AR Utilities. Enhancement to import customer remittance files from ftp, sftp or Azure blob storage using data entity Customer payment journal. A wide variety of setup options allows flexibility on method to find the customer account, settlement, posting date, custom file mapping etc. • Import customer remittance setup • Import customer remittance processing |

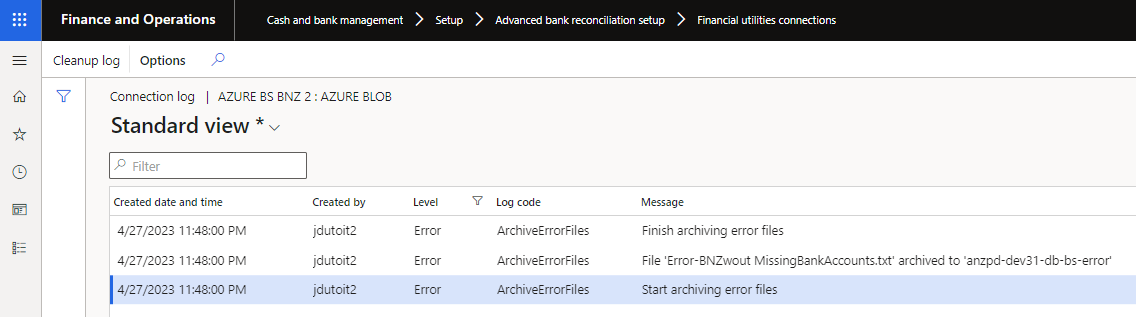

| 13907 | Financial utilities connection | Where file is moved to error path/container, the Financial utilites connection’s Log Level will be set to Error. Set connection’s Logging level to Error and use custom alerts to be alerted when a file has been moved to error path.  |

| N/A | License manager | License manager version 10.8.32.10171 Enhanced Licensing capabilities to assist with licensing support and scaling. Note: Required to upgrade all installed DXC products to at least the following versions: • EDI 10.0.29.202305053 • Finance utilities 10.0.29.202305051 • SmartSend 10.0.29.202304142 • Core extensions 10.0.29.202304142 • DocuSign 10.0.29.202304211 • Item creation 10.0.29.202304211 • PLM 10.0.29.202304211 • Forex 10.0.29.202305101  |

Bug fixes

| Number | Functionality | Description |

|---|---|---|

| 12857 | Data entity - Reconciliation matching rules | Reverse changes for 11749. Removed fields added back. |

| 12888 | Data entity - Financial utilities connections | Fixed entities required to import Financial utilties connections |

| 10429 | Data entity - Reconciliation matching rule | When importing entity, the Offset account was imported with Chart of account delimiter after the ledger account. |

| 14093 | Reconciliation matching rules | Security: Maintain privilege added for Copy matching rule. Added to Duty ‘Enable bank management process’. |

Release date: 17 April 2023

Bug fixes

| Number | Functionality | Description |

|---|---|---|

| 13788 | Bank reconciliation | Modified fix for 13592 to use Accounting currency instead of Reporting currency. |

Release date: 30 March 2023

Bug fixes

| Number | Functionality | Description |

|---|---|---|

| 13592 | Bank reconciliation | Exchange rate issue when using Mark as new and Offset account type is set to Vendor. When the currency differs to the legal entity, and the posted vendor transaction is selected to be used in settlement, the transaction’s amount doesn’t update the Settlement balance. |

| 13620 | Vendor bank account approval | From 10.32 MS has introduced their own Vendor bank account approval. MS used the same method name processChangesForApproval as we used for Finance utilities functionality. We’ve updated ours to avoid compile issues from 10.0.32. |

Release date: 3 March 2023

Bug fixes

| Number | Functionality | Description |

|---|---|---|

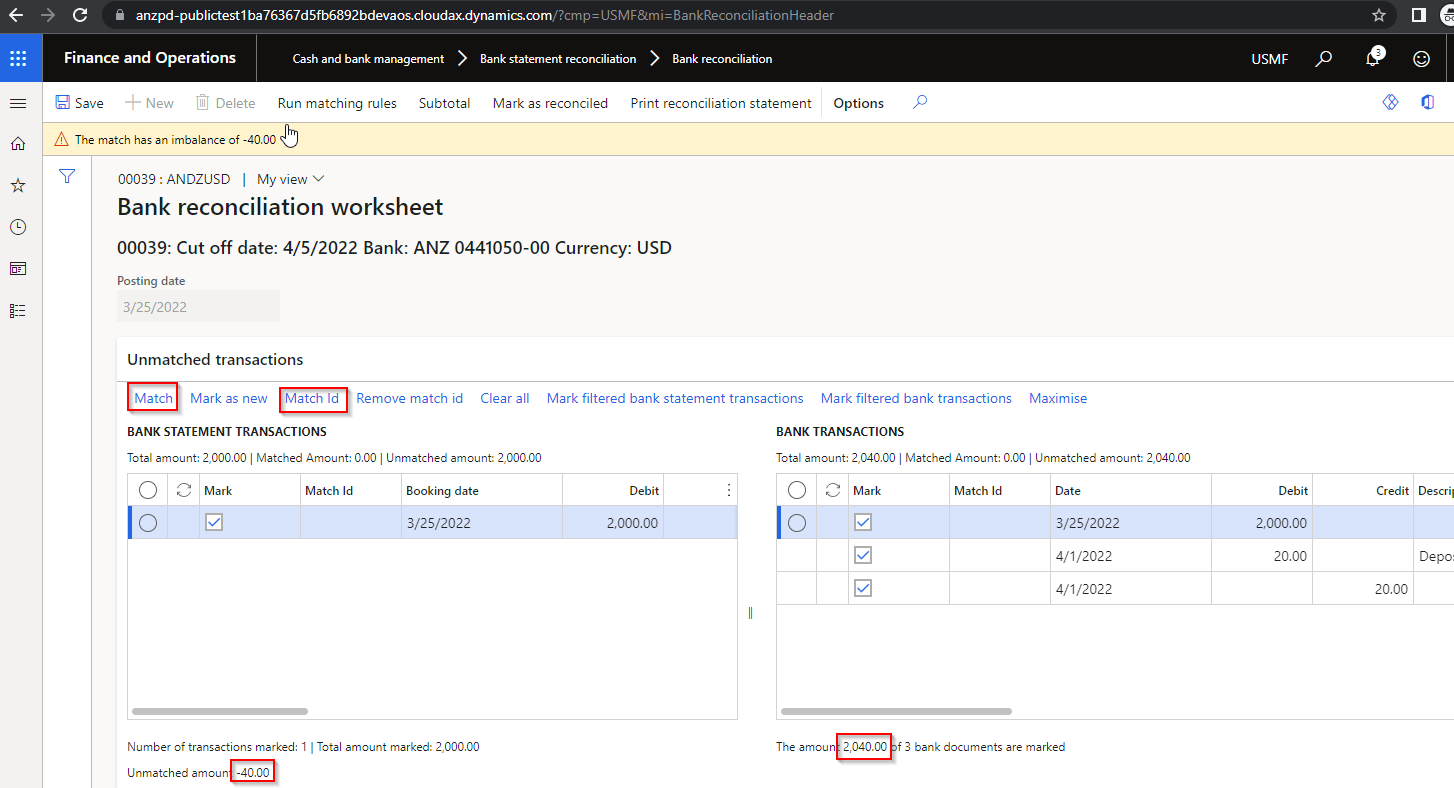

| 11505 | Reconciliation matching rules | Bank reconciliation: When running multiple Reconciliation matching rules with Action set to Mark new transactions and Offset account type set to Customer, errored with ‘No statement lines have been marked. The match has an imbalance of %amount%’. |

| 12801 | Reconciliation matching rules | Bank reconciliation: When running Reconciliation matching rules with Action set to Mark new transactions and Offset account type set to Customer and Auto-post customer payment journal set to Yes, and there was an issue with posting the customer payment journal (for example customer is stopped) the bank statement transactions were still matched. |

Release date: 27 February 2023

New features

| Number | Functionality | Description |

|---|---|---|

| 12934 | Bank statement import | Support DXC X++ replacement for XSLT depreciation |

Release date: 22 February 2023

Bug fixes

| Number | Functionality | Description |

|---|---|---|

| N/A | DXC Encryption | Update to DXC encryption. Resolve error: Module ‘DXCEncryption’ is missing the following dependencies: ‘ApplicationFoundationFormAdaptor’ |

Release date: 14 February 2023

| Number | Functionality | Description |

|---|---|---|

| 12825 | DXC Encryption | Remove unwanted model references |

Release date: 31 January 2023

New features

| Number | Functionality | Description |

|---|---|---|

| 11653 | Encryption / Decryption | New model DXC Encryption. Encryption/decryption options added to following Finance utilities functionality: • Encrypt option on Electronic reporting export connections to send encrypted GER Vendor EFT files • Decrypt option on Financial utilities connection to decrypt a bank statement file imported using periodic task Import bank statements via financial utilities connection. User guide |

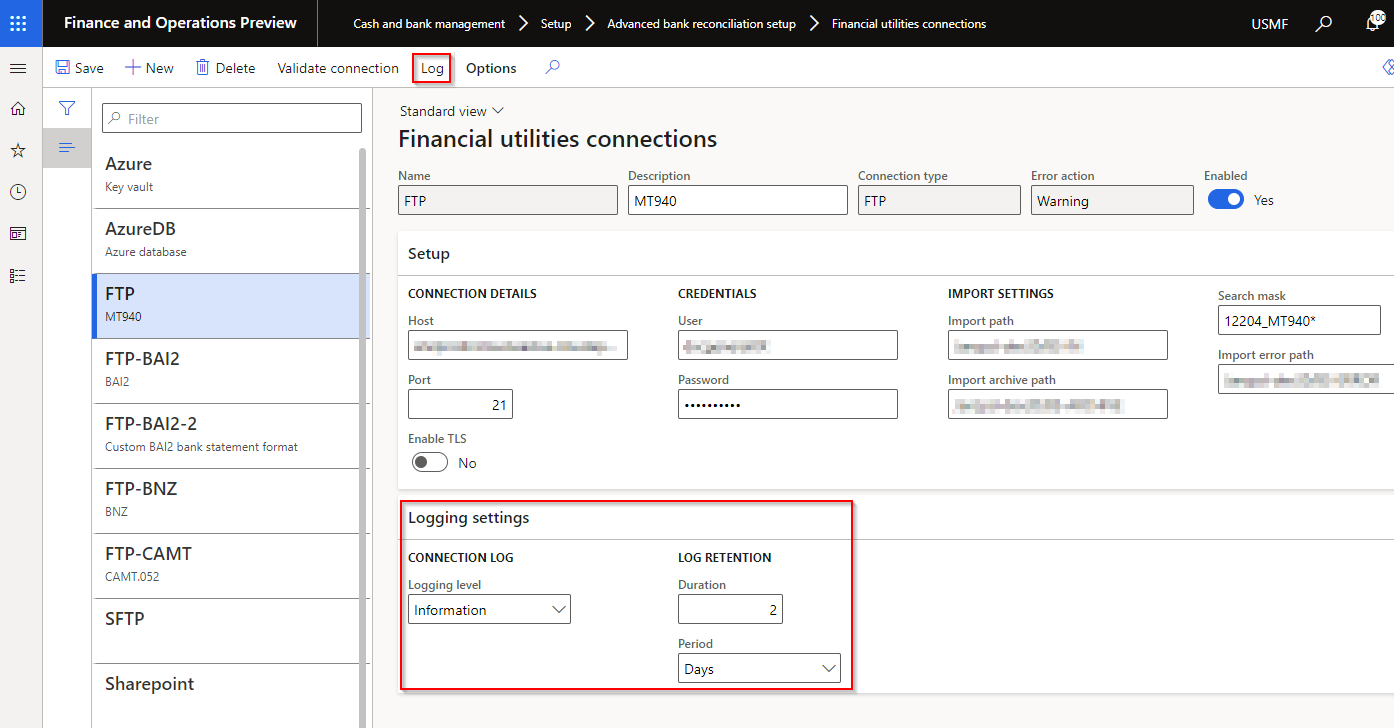

| 12119 | Financial utilities connection | Log ability added to all connection types. Ability to set Logging level and Retention period. This provides users the ability to set Custom alerts. For example if a connection can’t connect a log with level Error can be created.  |

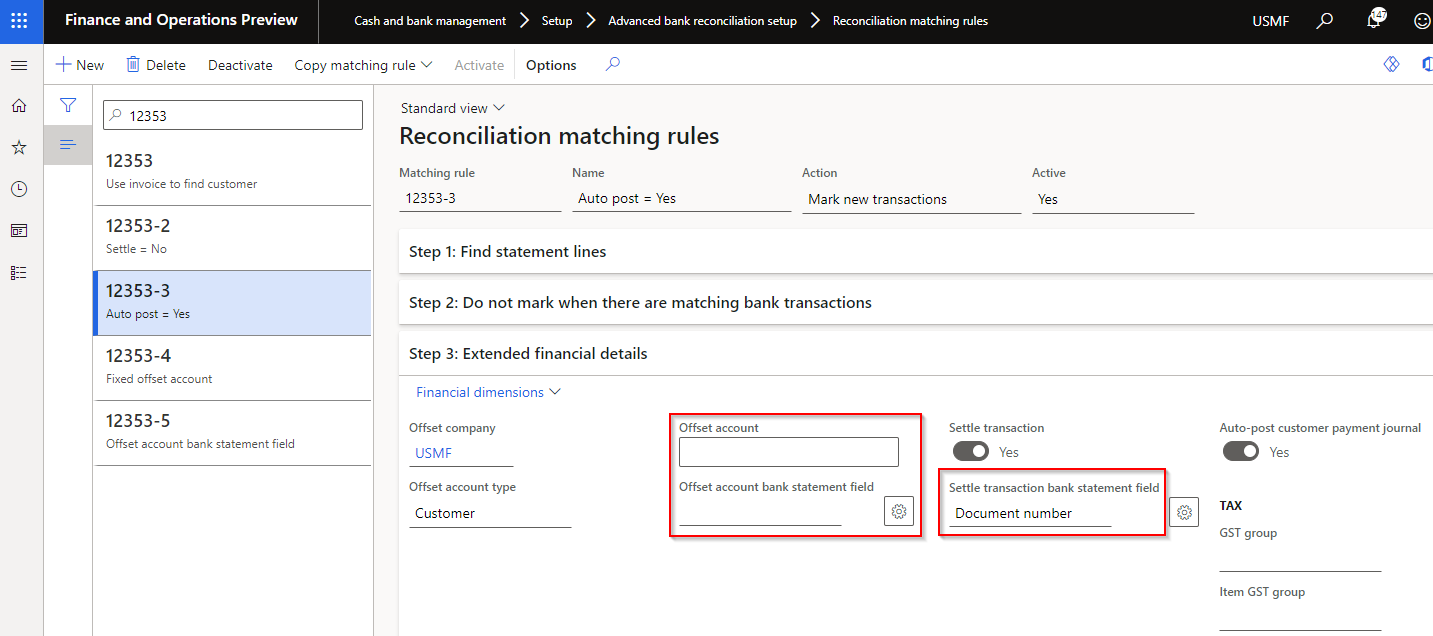

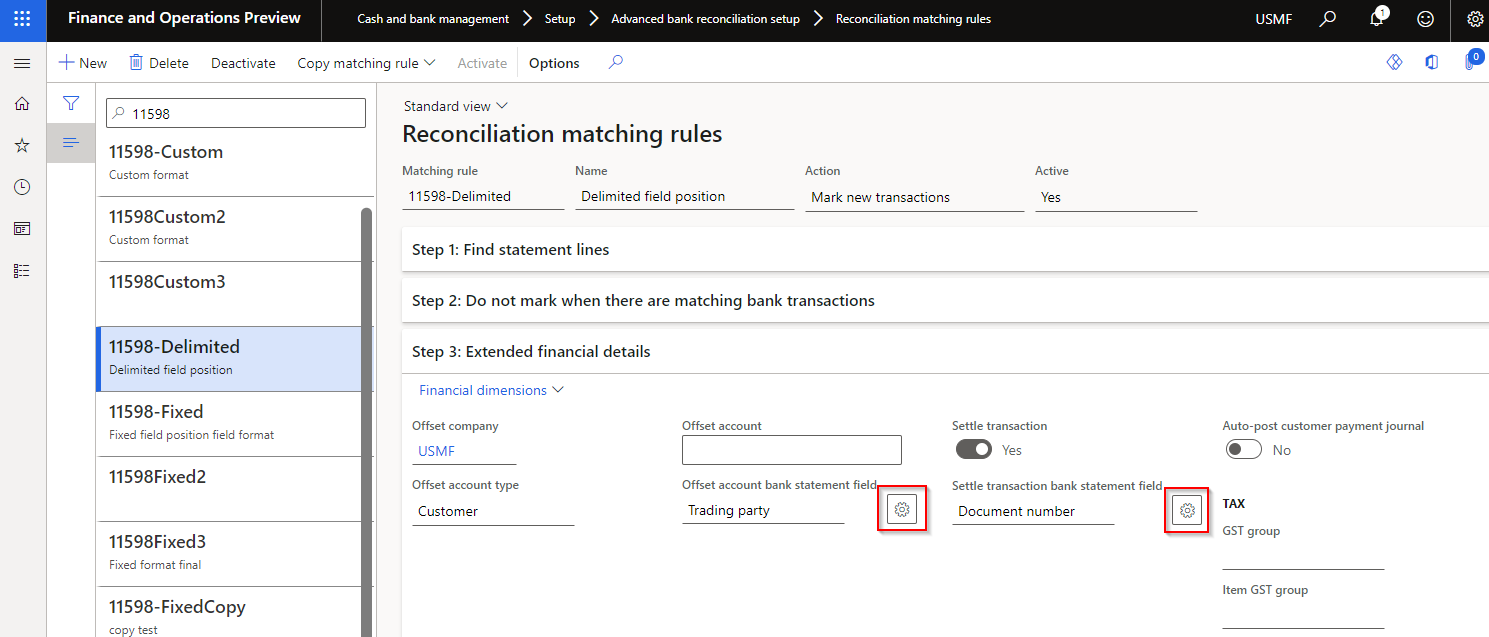

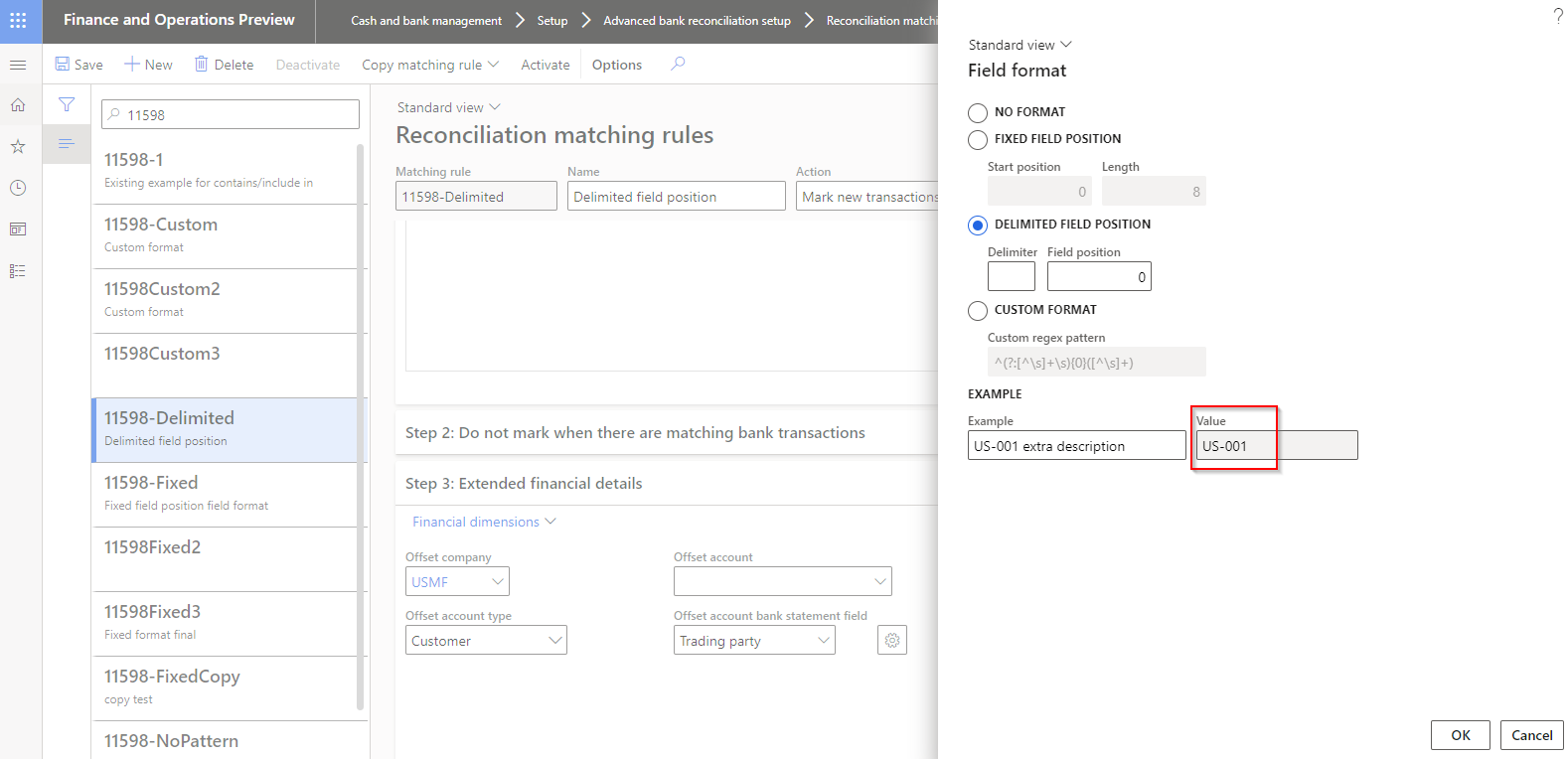

| 12353 | Reconciliation matching rules | Ability to use invoice to find the D365 customer account. Applicable to Offset account type set to Customer and where Offset account and Offset account bank statement field are both blank. When running the Reconciliation matching rule, the field mapped to Settle transaction bank statement field (D365 invoice number) will be used to find the D365 customer account, to create the Customer payment journal line. User guide  |

| 10419 | Data entity - Bank accounts | Added following field to entity ‘Bank accounts’: • Financial utilities connections |

| 10425 | Data entity - Vendor payment method | Added following field to entity ‘Vendor payment method’: • Sundry method of payment • Auto payment reference number • BPAY method of payment |

| N/A | License manager | License manager version 10.8.32.10156. Help includes links to applicable GitHub user guide page/s  |

Bug fixes

| Number | Functionality | Description |

|---|---|---|

| 12324 | Bank statement import | When a custom bank statement format was used and the file contained a bank account that isn’t setup for advanced bank reconciliation, the bank statement headers were created for the bank accounts setup with advanced bank reconciliation, but no bank statement lines were created. The fix now creates the bank statement lines for the bank accounts setup as advanced. Note: Std GER doesn’t import any bank statements where the file contains a bank account not setup as advanced bank reconciliation. |

Release date: 30 Nov 2022

New features

| Number | Functionality | Description |

|---|---|---|

| 11749 | Data entity ‘Reconciliation matching rules’ | Removed unused fields from data entity ‘Reconciliation matching rules’: • DFUACCOUNTTYPE • DFULEDGERDIMENSIONDISPLAYVALUE |

Bug fixes

| Number | Functionality | Description |

|---|---|---|

| 12204 | Bank statement import | Error importing GER bank statement with bank accounts with same Bank account id and same Statement Id across multiple companies. Error: “Cannot edit a record in Bank statement account statement (BankStmtISOAccountStatement). Update operations are not allowed across companies. Please use the changecompany keyword to change the current company before updating the record.” |

Release date: 24/10/2022

New features

| Number | Functionality | Description |

|---|---|---|

| 11598 | Reconciliation matching rules | Ability to set Field format for Offset account bank statement field and Settle transaction bank statement field. This assists in obtaining the D365 customer account and Invoice number from bank statement fields for creating the customer payment journal. For setup information and examples click here   |

Bug fixes

| Number | Functionality | Description |

|---|---|---|

| 11623 | Customer bank account entity | Related to version 10.0.27.202209162. Error when importing data entity Customer bank accounts: Field ‘Reference’ must be filled in’ |

| 11632 | Security | Related to version 10.0.27.202209162. Fixed security on Proposed changes for Customer approval. New privilege DFUCustChangeProposal added to following duties: • Approve customer change proposals • Maintain customer master |

Release date: 19/10/2022

DXC Finance Utilities 10.0.27 runs on the following Microsoft releases

| Base | Version | Release |

|---|---|---|

| Microsoft Dynamics 365 application | 10.0.27 | What’s new or changed in Dynamics 365 application version 10.0.27 |

| Microsoft Dynamics 365 application | 10.0.28 | What’s new or changed in Dynamics 365 application version 10.0.28 |

Same as 10.0.29.202210191 version, but excludes change that isn’t backwards compatible for D365 versions earlier than 10.0.29:

| Number | Functionality | Description |

|---|---|---|

| 11568 | Bank statement periodic import | Due to a change in MS code in 10.0.29. Periodic import created the Bank statement(s), but: • File was moved to Error folder (instead of Archive folder) • Document not attached to Bank statement(s) • ‘Imported via financial connection’ not set to Yes. Also fixes issue for ‘Reconcile after import’ (manual import and via periodic import) |

Release date: 29/09/2022

| Number | Functionality | Description |

|---|---|---|

| 11568 | Bank statement periodic import | Due to a change in MS code in 10.0.29. Periodic import created the Bank statement(s), but: • File was moved to Error folder (instead of Archive folder) • Document not attached to Bank statement(s) • ‘Imported via financial connection’ not set to Yes. Also fixes issue for ‘Reconcile after import’ (manual import and via periodic import) |

Release date: 16/09/2022

DXC Finance Utilities 10.0.27 runs on the following Microsoft releases

| Number | Functionality | Description |

|---|---|---|

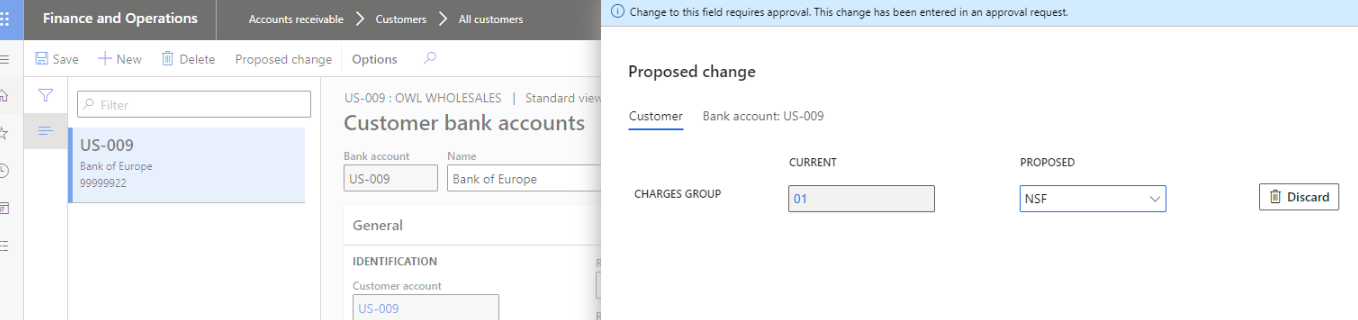

| 10814 | Customer approval | Accounts receivable > Setup > Accounts receivable parameters Ability to select the following Customer bank account fields in Customer Approval: • Bank groups • BSB number • Bank account number • SWIFT code • IBAN Ability to select the following Customer account fields in Customer Approval: • Allow on account • Unlimited credit limit • Exclude from credit management • Invoicing and delivery on hold (blocked) • Charges group • Customer rebate group • Commission group • Payment schedule Proposed changes will contain all fields that requires approval, split into a tab for customer and a tab for each bank account with changes. Note: Using Discard all changes on Proposed changes will discard changes on all tabs.   |

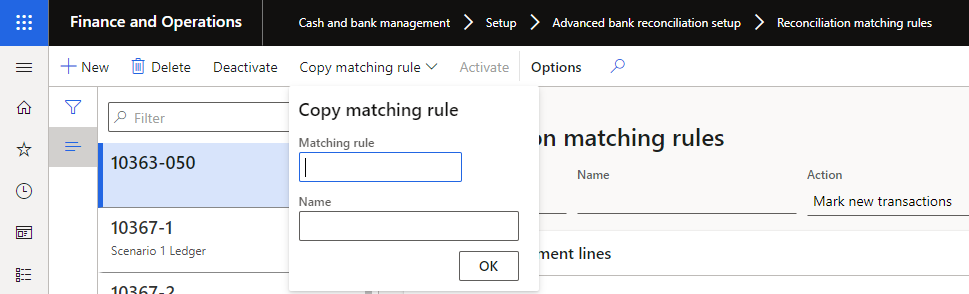

| 10607 | Reconciliation matching rules | New Copy matching rule button provides the ability to copy an existing rule, edit and activate.  |

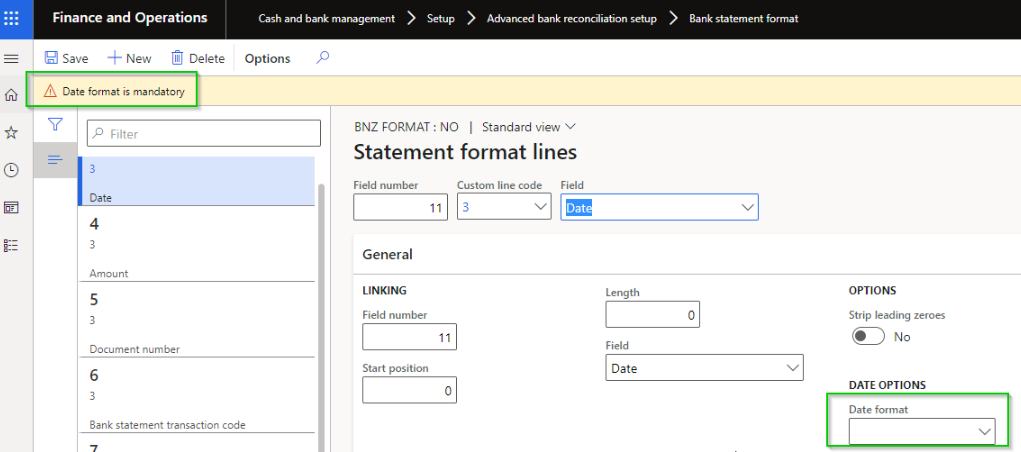

| 10859 | Bank statement format | When setting up a custom format, and creating the Date field statement line, field Date format is now mandatory.  |

| 10468 | Financial utilities parameters | About tab removed. Support info now availabe in workspace Organization administration > Workspaces > DXC support. |

Bug fixes

| Number | Name | Description |

|---|---|---|

| 11305 | Generic electronic Import format | Fix issue with importing GER bank statement formats. Supports Advanced bank reconciliation statement model (ABR) and Bank statement model GER formats. |

| 10927 | Bank statement import | Fix to incorrect log when importing bank statements for banks across multiple legal entities. Error: ‘No matching bank account found’ for bank accounts in the different legal entity. |

| 11262 | Bank reconciliation | Can’t select Offset company in Matched transactions when manually marking a bank statement transaction as new in Bank reconciliation Worksheet. Only an issue for FinU release 10.0.25 & 10.0.27.202207142 |

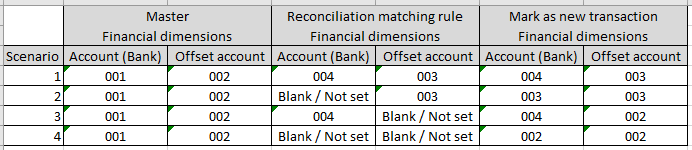

| 11307 | Bank reconciliation | Fix to financial dimensions posted for manually marked as new bank statement transactions. Bank account’s transaction incorrectly posting without financial dimensions (10.0.25 & 10.0.27.202207142). Updated logic when user selects Mark as new and the records are moved to Matched transactions: • Account (Bank)’s financial dimensions will be populated from the Bank account. • When user enters Offset account number, the offset account’s financial dimension will be populated from their master accounts (for example customer’s financial dimension), except ledger since it is populated in Offset account number. If this would result in a blank value it will be populated with Account (Bank)’s financial dimensions. • If Account (Bank)’s financial dimensions are blank, Offset account’s financial dimensions will be used to populate Account (Bank)’s financial dimensions. |

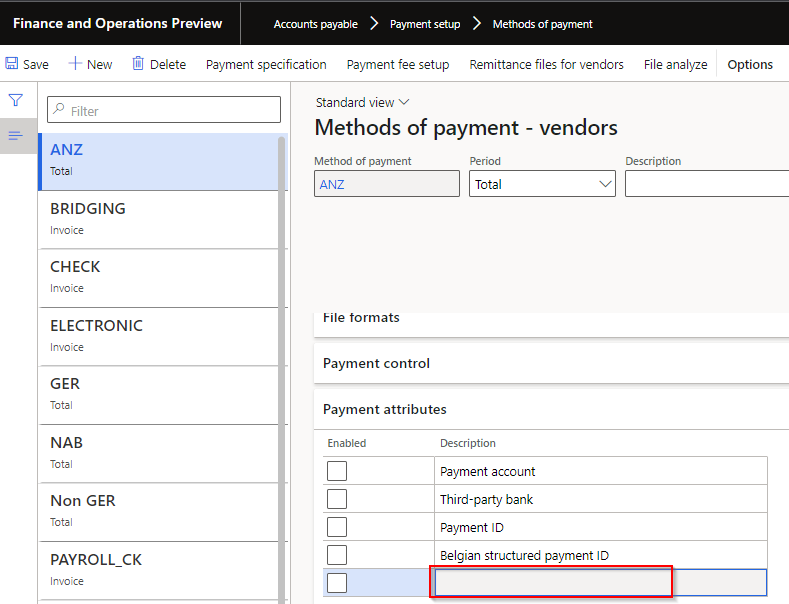

| 10422 | Vendor method of payment | Lodgement reference Payment attribute displaying as blank. Std’s D365 last record in Attributes (Belgian structured payment ID) is region based and resulted in any records after it displaying blank.  |

Release date: 14/07/2022

| Number | Functionality | Reason |

|---|---|---|

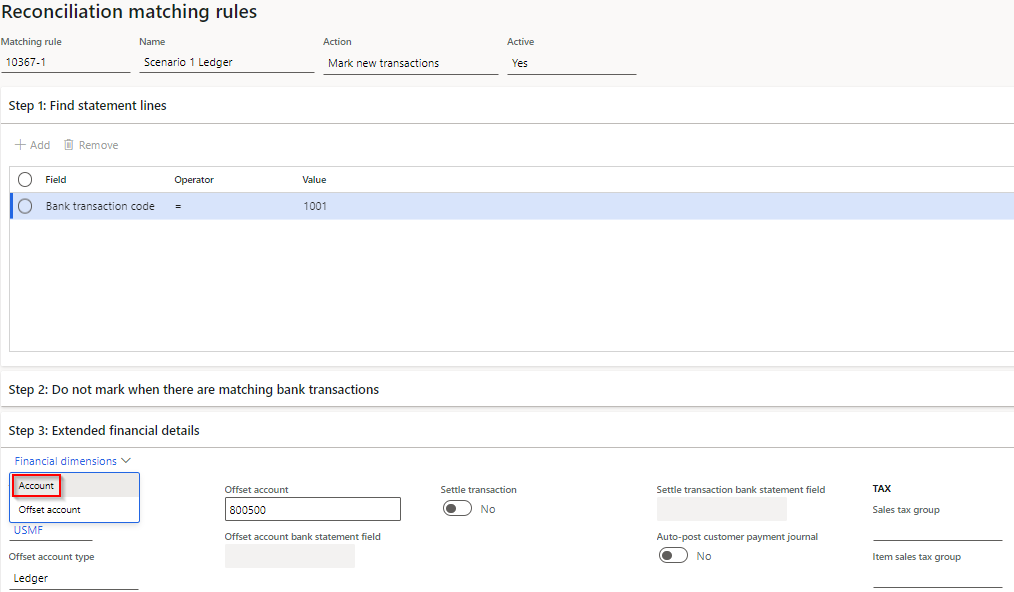

| 10367 | Reconciliation matching rule | Ability to set Account’s Financial dimensions on Reconciliation matching rules with Action Mark new transactions.  New posting logic for financial dimensions: • Account is Bank • Offset account is Ledger, Customer, Vendor or Bank.  When new bank statement transactions with Offset account type Ledger, Vendor or Bank’s are matched by using Reconciliation matching rules, the calculated financial dimensions for Account and Offset account are populated on the Matched transaction’s Financial dimensions tab and can be overriden prior ‘Mark as reconciled’. Offset account type Customer creates customer receipt journal(s) with the calculated financial dimensions for Account and Offset account. |

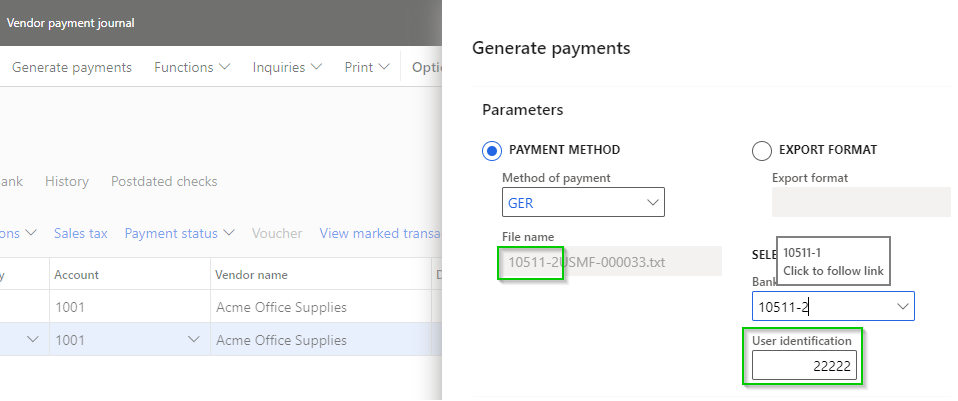

| 10511 | Vendor payments - Generate payments | Current vendor payment journal line’s Method of payment and Bank account used to populate fields on Generate payments dialog. |

Bug fixes

| Number | Name | Description |

|---|---|---|

| 10511 | Vendor payments - Generate payments | Electronic reporting format: User id and File name updated if Bank account is changed on Generate payments dialog.  |

| 10603 | Bank reconciliation | Where a bank deposit slip has been cancelled the MS calculated totals are incorrect and resulted in an unmatched amount. Financial utilities unmatched amount calculation has been updated to avoid this issue.  |

Release date: 14/07/2022

Same as 10.0.25.202207142, and includes the fix for Payment advice V2 required from 10.0.27:

| Number | Functionality | Reason |

|---|---|---|

| 10284 | Eclipse Payment advice V2 | Resolves the breaking change with Microsoft introduced new 10.0.27 features when Enable batch processing for bank payment advice reports is enabled. |

Release date: 17/06/2022

| Number | Functionality | Reason |

|---|---|---|

| 10241 | Bank statement import - Document handling | New field File attachment document type added to Financial utilities parameters. When Type has been selected, the import file will be attached to the created bank statement(s). This applies to bank statements created with manual or periodic job import. |

| 10293 | Financial utilities connections - Validate connection | New button Validate connection added to Financial utilities connections. Validates: • Connection details • Import path • Import archive path • Import error path |

| 10363 | Only match posted statement lines | New field Only match posted statement lines added to Financial utilities parameters. For example mark as new bank reconciliation rule finds three records in the bank statement, but only two of the customers exist and thus won’t balance since only two lines were posted as customer payment journal lines. This option only applies to where the mark as new bank reconciliation creates and posts new customer payment journals. |

| DXC License manager 10.8.32.10131 | Improvements to DXC License manager model |

Bug fixes

| Number | Name | Description |

|---|---|---|

| 10449 | Eclipse Payment advice V2 - Generate payments for BNZ file | Fix Print payment advice via Generate payments for Eclipse Payment advice V2 report when using BNZ Direct Credit Service (NZ) export format on the method of payment. |

| 10292 | Customer Bank recon matching rule - Transaction type | When reconciliation matching rule creates and posts the customer payment journal, the transaction type was Customer. Transaction type has been fixed and will now be posted as Payment. |

Release date: 29/06/2022

| Number | Functionality | Reason |

|---|---|---|

| 10341 | DXC License manager 10.8.32.10141 |

New workspace Organization administration > Workspaces > DXC support. Links for licensed products to: • User guide • Release notes • Contact - email address for support |

| 10284 | Eclipse Payment advice V2 | Resolves the breaking change with Microsoft introduced new 10.0.27 features when Enable batch processing for bank payment advice reports is enabled. |

| Number | Functionality | Reason |

|---|---|---|

| 8461 | Bank statement import | Ability to automatically import bank statements from ftp, ftps, sftp, Azure blob storage, or SharePoint |

| 10094 | Reconciliation matching rule – unique voucher | New Financial utilities parameters field called Populate unique voucher for each journal line. When customer payment journal is created using the additional Finance utilities fields on Reconciliation matching rules (for mark as new transactions), this new field provides options if the journal will be created with unique vouchers for each line. If new field is enabled, General ledger parameters’ Allow multiple transactions within one voucher doesn’t need to be enabled. |

| 10274 | Reconciliation matching rule – Invoice has been marked by another customer payment journal | If Reconciliation matching rule for mark as new transaction are set to settle the customer invoice, and the invoice has already been marked in another open journal, D365 doesn’t allow the invoice to be selected. In this scenario the customer payment journal line will now still be created (previously didn’t) but with no invoice selected for settlement. |

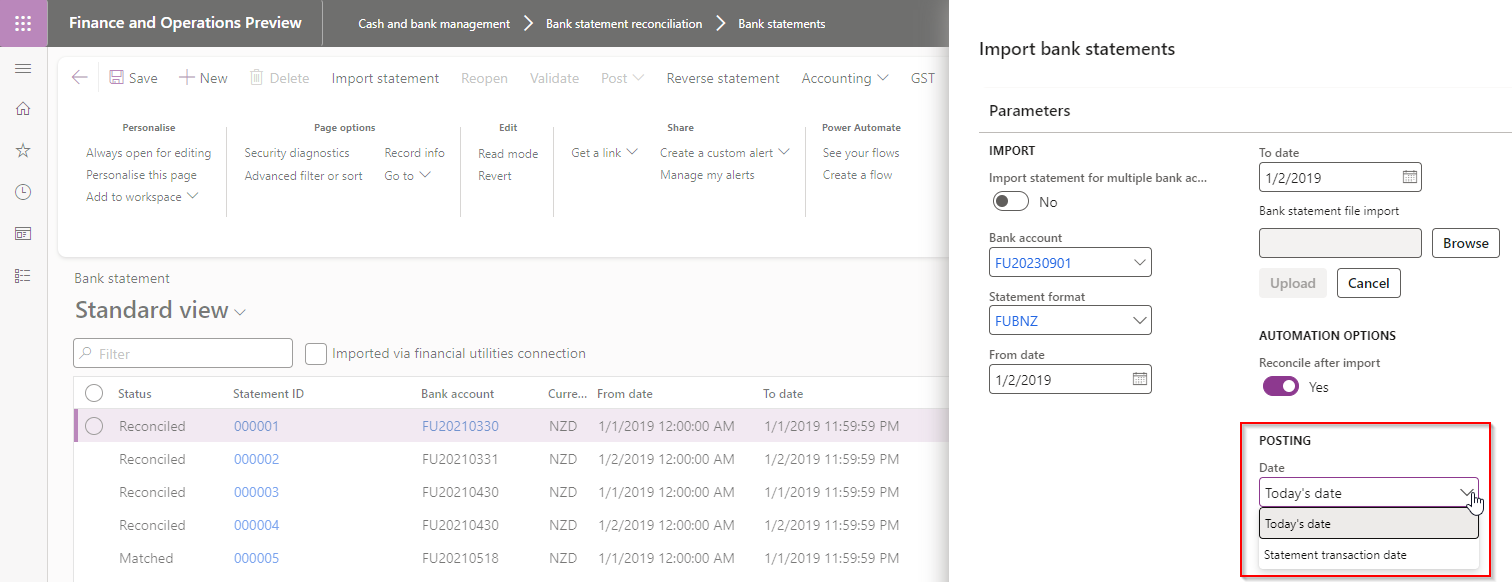

| 10152 | GER bank statement format | Support importing Bank statement formats using GER (Electronic reporting), and supports setting posting date (for mark as new transactions) to: • Statement transaction date, or • Today’s date |

| Number | Functionality | Reason |

|---|---|---|

| 9490 | ABN search and validation | Ability for Australian companies to search and validate ABN for customers and vendors. |

| 9925 | Auto-post bank statement | When Financial utilities parameter ‘Auto-post bank statement’ is set to Yes, only Bank statement’s with status Reconciled will automatically be posted. Previously bank statements containing unreconciled lines, Bank statement’s status is Matched, were also automatically posted. But the unreconciled lines are included in the next bank reconciliation and when users run mark as new matching rule in the next recon, it would error with ‘The bank statement % is posted already and cannot be changed’. |

| 9505 | Populate bank transaction document number | Populating the document number in bank reconciliation’s bank transactions. From 10.0.22 MS has removed ‘Turn off reconciliation worksheet performance enhancement’ parameter. Not required anymore: RemoveLoadReconciliationWorksheetExtensibleFlight_KillSwitch |

| 9688 | Reconciliation matching rule (1:1 customer and invoice) | Write Bank statement’s Description to Customer receipt journal. Also added the new Finance utilities fields to entities ‘Reconciliation matching rules’ and ‘Financial utilities parameters’ |

Bug fixes

| Number | Name | Description |

|---|---|---|

| 9665 | Print payment advice | Error when feature ‘Enable batch processing for bank payment advice reports’ is enabled and printing the payment advice V2 for an ECL EFT format via Generate payments in the Vendor payment journal. |

| 9986 | Compile errors | PEAP 10.0.26 Compile errors Error The Class ‘ERUserParameterDataContract’ is internal and is not accessible from the current module ‘DXC Finance Utilities’. K:\AosService\PackagesLocalDirectory\bin\XppSource\DXC Finance Utilities\AxClass_DFUVendOutPaymHandler.xpp 78 |

To align with MS best practice and to protect our IP the following applies to the release process.

Depending on the installation history follow one of these guides to install the new release.

If you’re installing the new release in an installation that already has a previous version of the product installed and you’re not using it for debugging or extension. We recommend that you;

If you’re using our model source code for extension or debugging and would like to continue using it, please do the following to apply the new release with the source code.

If you don’t follow these instructions and continue building your installation deployable package using the license model source code, the installation will continue using the same license model as before applying the release.

Enable the following features in D365 Feature management:

If above feature is not visible, press Check for updates to refresh the feature management list.